Banking Circle

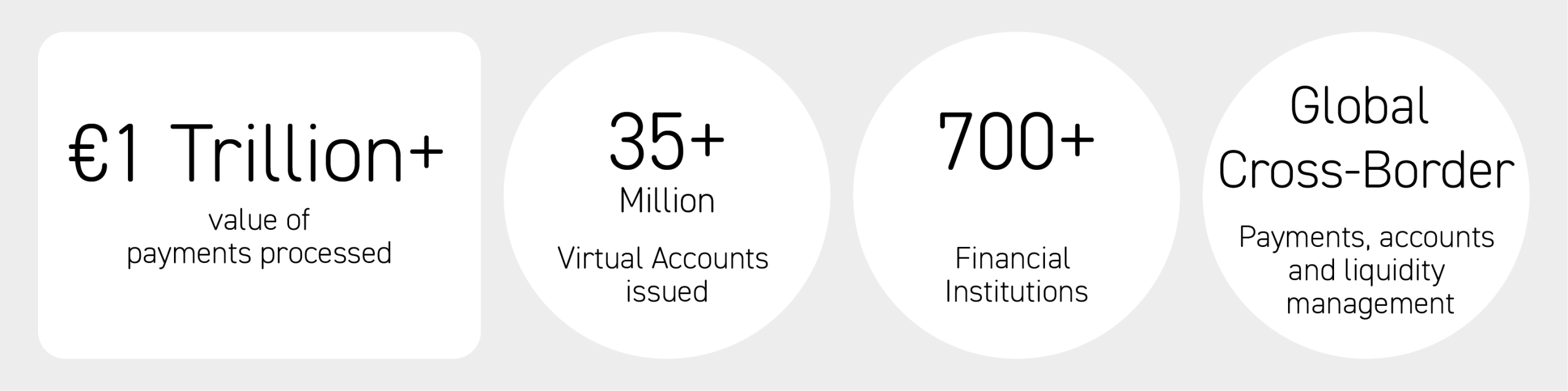

Banking Circle is a fully licensed bank with central bank clearing rails and world-class API’s. The bank offers cutting-edge physical and virtual accounts in multiple currencies.

Banking Circle is a modern financial technology platform. It offer a wide range of services including Accounts, Payments, Foreign Exchange, Treasury Management, Agency Banking, and Correspondent Banking. Trusted by over 700+ regulated financial institutions, its clients include leading names such as Stripe, Nuvei, Paysafe, PPRO, Airwallex, and many more.

Visit the Banking Circle website or watch this video on YouTube .

Clear Bank

Clear Junction

Clear Junction is an FCA-authorised Electronic Money Institution. They deliver

compliance-first payments infrastructure that bridges the gaps left by

traditional providers, helping financial institutions operate more efficiently

and expand globally.

Their proprietary technology enables banks, EMIs, PSPs, acquirers, and digital

asset companies to onboard for:

• Correspondent Accounts

• Collection Accounts

• Issuing Virtual IBANs for your customers

• GBP and EUR domestic payment rails

• FIAT and Stablecoin Payouts All backed by a robust regulatory framework

and global reach.

Currency Cloud

Equals Money & railsr

Equals Money provides payment and card services to businesses around the world. Working with UK & EU T1 banks, we issue named multicurrency IBANs, connected to SWIFT, SEPA/Instant and Faster Payment.

Businesses can issue virtual and physical cards to create a streamlined spend and expense management solution.

Customers can utilise the platform direct or leverage the API to choose key components that suit their business, or client base.

railsr provides a Global Embedded Finance Experience Platform which enables businesses to create amazing moments for your customers, or fans using embedded finance experiences.

Goldman Sachs

Goldman Sachs Transaction Banking’s platform provides clients an API-first approach to automating their corporate treasury operations.

LHV

Modulr

Payments aren’t working for businesses. Modulr’s software-driven payment services power innovation and deliver automation, security and control.