Trusek | Multi-Currency Fintech Core Banking Platform

Launch in 4 Weeks

Trusek helps FinTechs, Financial Institutions, and Neobanks launch multi-currency products FAST. Our cloud-native platform cuts build time from months to weeks, so you can reach the market sooner and generate revenue faster.

Why spend months building from scratch when you can go live in as little as four weeks? With Trusek, you can turn your product vision into a secure, scalable solution, without the usual cost, risk, or complexity.

Launch Faster with Trusek’s Multi-Currency Banking Platform

Trusek helps FinTechs, Financial Institutions, and Neobanks launch and scale multi-currency financial services in weeks, not months.

Our secure, cloud-based platform removes the friction caused by legacy systems, long build times, and high development costs. This means you can focus on growth instead of infrastructure.

With Trusek’s white-label platform, you can quickly design, test, and launch payment, FX, and banking products without disrupting your existing systems.

Whether you are entering new markets or adding new services, Trusek helps you move faster, stay compliant, and deliver better customer experiences.

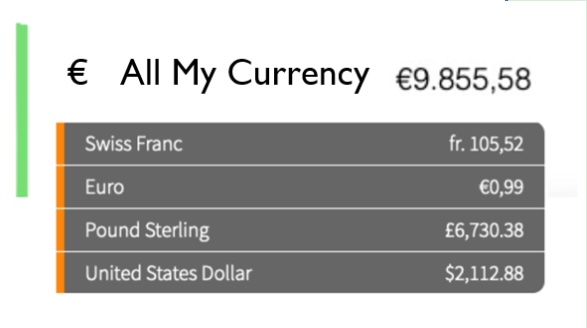

At the core is a simple multi-currency account view. Customers can hold multiple currencies in one account and see a single available balance. This makes cross-border payments easier and helps businesses reduce treasury and expense management costs.

transactions processed

securely processed

SLA

countries

currencies

Transform Development, Accelerate Innovation

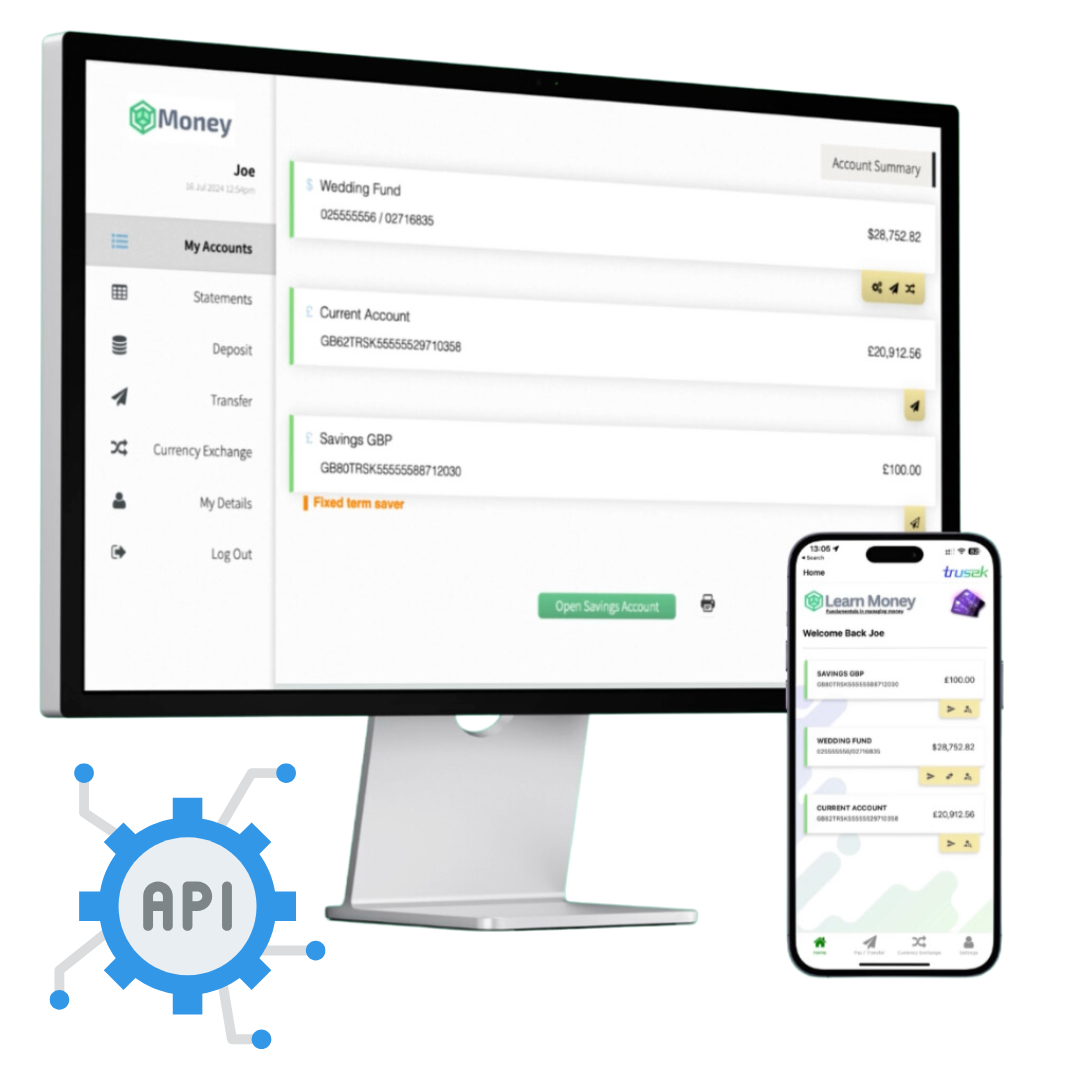

Trusek gives you everything you need to build, launch, and scale fintech products, FAST. Create new services or enhance existing ones in weeks, not months.

Our SaaS platform runs the core infrastructure behind the scenes, so your team can focus on innovation, differentiation, and customer value.

With Trusek’s powerful APIs, you can connect systems, add features, and bring your product vision to life with speed and control.

You can design the customer experience in-house, or work with Trusek to deliver fully branded web and mobile journeys.

Built on years of real-world delivery experience, the Trusek Core Account Platform provides a secure, flexible foundation for modern financial services—ready to grow as you do.

Power End-to-End Financial Management

Trusek’s ready-to-go solution is built around a robust Core Account Management Platform. It enables you to manage customer funds end to end, from deposits and FX through to payments and settlement.

The platform is secure and compliant by design, supported by enterprise-grade hosting, strong security controls, and clear reporting and audit logs.

Trusek integrates seamlessly with specialist providers for banking, payments, and compliance, allowing you to plug in the services you need without reworking your core platform.

As your business grows, you can connect additional platform instances to support multiple countries and regulatory frameworks, while keeping operations consistent, controlled, and scalable.

And you’re not doing it alone. Trusek’s implementation team supports delivery end to end, assisting with licensing, and making introductions to trusted partners including banks, compliance specialists, and FX brokers.

- Accessible investment management services for any device.

- Customised advice based on financial situation and goals.

- Offering diversified investment portfolios for individual needs.

Account Management

- Joint accounts

- Company accounts

- Savings, Loans & Overdrafts

- Multi-currency

- Payments & Settlement

- Reconciliation

Hosting & Security

- Server and firewall management

- Deployment & patching

- Monitoring

- Replication & backups

- Logging & reporting

- API provision

Connections

- Connect Multiple Core Platforms

- Create a Payments Network

- Single point of Management

- Integrate Service providers

- Provide value added services

Payments

- Third-Party Integrations

- Real-time Account Updates

- Efficient Bulk Payments

- Streamlined Reconciliation

- Comprehensive Reporting

Currencies

- Dynamic Multi-Currency Accounts

- Access to over 65 currencies

- Control Over Conversions

- Comprehensive Trading Support

- Supports Spot, Limit, and Future trades

- Enables real-time currency conversions

- Currency accounts set up in real-time

- Efficient Reconciliation

- Comprehensive Reporting

Additional Services

- EMI Sponsorship

- BIN Sponsorship

- Compliance

- Card Issuing & Acquiring

- Foreign Exchange

- Banking

Risk & Compliance

- API Integration to 3rd Party KYB/ KYC/ AML / Sanction List Service Providers

- Set and regulate ongoing checking rules

- In-built transaction monitoring capability for countries, currencies, beneficiaries, transaction amounts, transaction volumes etc

- API Integration with 3rd Party Transaction Monitoring Providers

- Comprehensive Reporting

Why Trusek?

Secure and Reliable

Trust in a platform that is proven, secure, and stable, so you can focus on what matters most: delivering exceptional customer experiences.

Flexible by Design

Our platform adapts to your growth—whether you’re adding products, expanding globally, or evolving with the market’s demands.

Innovate Faster

Quickly create, test, and launch new products and services. Reduce costs, accelerate time-to-market, and stay ahead of the competition.

Customer-First Collaboration

We work as your partner, understanding your goals and delivering highly configurable, ready-to-go solutions that drive success.

Empowering Growth

Break down barriers to innovation. We provide the tools and flexibility to scale, compete, and thrive in today’s dynamic financial landscape.

Future-Ready Scalability

Our solutions grow with you. Stay ahead of the curve, embrace new opportunities, and shape the future of financial services.

Testimonials

3S Money

Trusek has been a partner of 3S Money even before we got our EMI license. Trusek engineers quickly grasped the idea of how to get started quickly and get into production in no time so we could start trading and prove our business case with MVP. The key elements were time to market, implementation cost and effort.

After the launch, the product has quickly been complemented to our requirements, wishes as well as withstood challenges from the financial providers. The set-up has demonstrated good uptime and resilience.

We appreciate attention that we are getting from Trusek management and engineers and how things move forward. Trusek has always contributed its expertise and analysis towards any developments we came up with. With running cost, solution transparency, response time and quality with honesty at all levels we believe our cooperation is a good match.

Umbrella Telecom Management Limited

I want to say a big thank you to the guys at Trusek. We came to them with a project which seemed a long way outside their standard product but they were able to design a solution that not only fitted seamlessly into their client but created a prospect wholesaling our telecoms service through other Trusek partners.

This provided us with a platform to grow both our remittance and our telecoms business on one platform. Since then, from time to time we require new functionality on our platform so we can offer new services to our customers or to improve our management capabilities. Trusek has a straightforward and efficient process for requesting, designing and implementing new features. Support from the Trusek team is excellent so we don’t need any technical knowledge to run our platform. Our working relationship with Trusek has boosted our productivity and revenue. We are very happy that we have Trusek as our long-term IT partner.

Right-Card

I previously worked with the Trusek team when I was Director of Alpha Transfers Limited, a London based remittance company. My experiences then gave me the assurance I needed that Trusek was the right partner for us. I first contracted them to consult with us on the FCA IT Controls, which was a major part of our application process to become an Authorised Electronic Money Institution.

With the help and guidance of the Trusek team we successfully completed our application process with the Financial Conduct Authority and RightCard is now a fully-fledged eMoney Institution.

Since then Trusek has provided us with a bespoke financial services platform incorporating a number of additional features we requested. We were confident that the tried and tested multi-currency e-wallet remittance platform which Trusek has developed would be perfect for our business. Our software platform offers a wide range of financial services through multiple channels giving us an edge over our competitors.

Throughout our time working together Trusek has been attentive to all our needs. They are easy to work with and always provide us with the right solutions.

Eugene Dugaev

Trusek has been a crucial partner to 3S Money, enabling a quick, cost-effective MVP launch. Their adaptable, resilient product, along with expert guidance, transparency, and responsive support, has made the collaboration highly effective and a perfect fit for our needs...

Kalaruban Thaniyaslam

Thanks to Trusek for creating a tailored solution that helped grow our remittance and telecoms businesses. Their efficient process for adding features and excellent support has boosted productivity and revenue. We’re happy to have them as our long-term IT partner...

Mauricio Barbosa

Having worked with Trusek at Alpha Transfers, I knew they were the right partner. They helped us become an Authorised eMoney Institution and provided a tailored platform that gives us a competitive edge. Trusek is always attentive, easy to work with, and delivers the right solutions...