Welcome to Trusek’s Payment Methods Glossary — your go-to reference for understanding key terminology in payments and financial tech. Here you’ll find definitions of all major payment methods and web links to authoritative sources.Whether you’re a fintech startup, developer, or payments professional, this glossary helps you stay informed on payment types, tech, and trends.

UK Payment & Banking Market

The UK has a robust payments infrastructure with several key systems, each with its own limitations.

- Faster Payments: A near-real-time electronic payment service. While the system can handle payments up to £1 million, most banks set their own limits, which can be significantly lower. Personal online banking limits are often around £25,000, with business limits and in-branch payments having higher ceilings.

- BACS (Bankers’ Automated Clearing Services): A system for electronic payments that clears over three working days. It’s primarily used for recurring payments like salaries (via Direct Credit) and bills (via Direct Debit). BACS payments have a maximum transaction value of £20 million, though banks may impose lower limits for their clients.

- CHAPS (Clearing House Automated Payment System): A same-day sterling payment system for high-value and time-critical payments. There is no upper limit on CHAPS payments, making it the go-to system for transactions like property purchases.

- Direct Debit: A payment method where a company is authorized to collect variable amounts from your bank account on a set schedule. There is no hard-and-fast limit set by the scheme itself; the limits are typically defined by the creditor or your bank.

- Standing Order: A fixed, recurring payment you set up with your bank. The maximum amount is typically subject to your bank’s Faster Payments limits, as most standing orders are processed via this system.

- Confirmation of Payee (CoP): A fraud prevention service that verifies if the name on a recipient’s account matches the one provided by the payer. This is not a payment method itself and therefore has no transaction limit.

Europe (EU) Payment & Banking Market

The EU operates under a harmonized payment framework called SEPA to facilitate cross-border transactions.

- SEPA Credit Transfer (SCT): The standard SEPA payment method for one-off euro transfers. There is no maximum transaction value set by the SEPA scheme, but individual banks may apply their own limits.

- SEPA Instant Credit Transfer (SCT Inst): An instant payment scheme for euro transactions. The European Payments Council (EPC) previously set a maximum limit of €100,000. However, the Instant Payments Regulation now removes this scheme-wide maximum, allowing Payment Service Providers (PSPs) to set their own limits. This flexibility enables higher-value instant transactions.

- Verification of Payee (VoP): A new scheme being implemented in the EU that mandates payment service providers to verify that the IBAN and the payee’s name match. As a fraud-prevention tool, it is not a payment method and has no transaction limit.

US Payment Market

For comparison, here are two key US payment systems.

- ACH (Automated Clearing House): The US network for electronic bank-to-bank payments. ACH payments are processed in batches and are not instant. Nacha, the organization that oversees the network, has raised the limit for Same-Day ACH to $1 million. However, individual banks often set their own, lower limits.

- Link: https://www.nacha.org/

- FedNow: A new instant payment infrastructure from the Federal Reserve. The transaction limit for FedNow has been increased from the default of $100,000 to $1 million. Financial institutions can choose to use this higher limit.

SWIFT - International Payments

What does SWIFT stand for?

Society for Worldwide Interbank Financial Telecommunications

🔗 Official website: https://www.swift.com

What is SWIFT?

SWIFT is a global messaging network used by banks and financial institutions to securely exchange information about cross-border payments, securities, and financial transactions. It does not move money itself, but instead provides the standardized communication layer that enables international transfers.

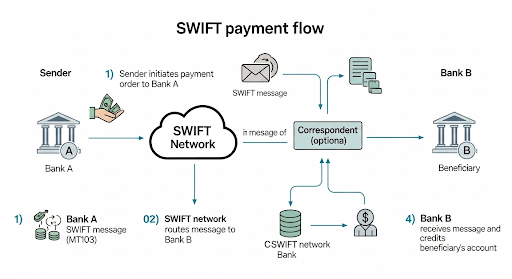

How Does SWIFT Work?

- A bank sends a payment instruction (e.g., from London to New York).

- SWIFT transmits the message in a standardized format to the receiving bank.

- The funds are settled through correspondent banks or central bank networks.

This process ensures accuracy, security, and interoperability across thousands of banks worldwide.

Key Features of SWIFT

- Global Reach: Used by more than 11,000 institutions in over 200 countries.

- Standardization: Every message follows ISO 20022 (gradually replacing MT formats).

- Security: Encrypted messaging and strict governance ensure reliability.

- Flexibility: Supports payments, securities trades, FX confirmations, and more.

SWIFT vs SEPA / Faster Payments

- SWIFT = International, cross-border, typically slower and more expensive.

- SEPA / Faster Payments = Domestic/regional schemes (EU or UK) offering faster, cheaper payments.

Limitations of SWIFT

- Costly: Fees often range between $10–50 per transfer.

- Slow: Transfers can take 1–5 business days.

- Reliance on Intermediaries: Multiple correspondent banks can delay settlement.

Why SWIFT Matters in the UK & EU

Despite new alternatives like SEPA Instant, Faster Payments, and even blockchain rails, SWIFT remains the backbone for global B2B and cross-border transactions.

For regulated entities (EMIs, PSPs, banks), SWIFT membership or access via a partner bank is essential for offering full international money transfer services.