Products Overview

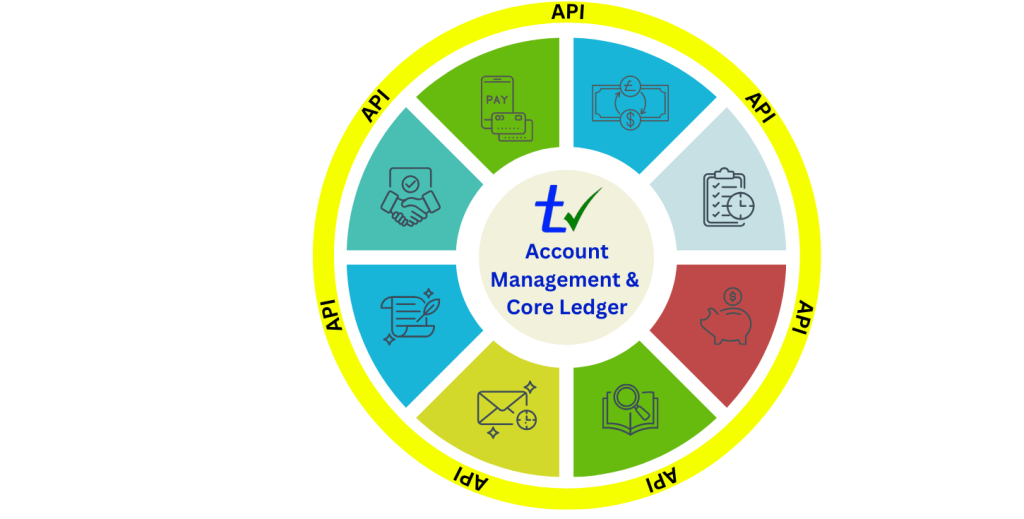

Trusek has developed a comprehensive, ready-to-go Core Banking (BaaS) platform that brings together ledger, account management, risk, compliance, and reporting in one integrated solution.

This robust foundation enables a wide range of connected financial services, giving you the flexibility to launch, operate, and scale modern banking products with confidence.

Payment & Settlement

Processing

Trusek’s Payment & Settlement module supports both real-time and batch payments, giving you a single, reliable way to execute, track, and reconcile transactions at scale.

Key capabilities include:

- Real-time Payment Processing:

Process instant payments via integrations with payment schemes such as FPS, SEPA Instant, and FedNow. - Automated Payment Processing:

Handle scheduled and bulk payments through BACS, CHAPS, SWIFT, ACH, and SEPA, with no manual intervention. - Seamless Third-Party Integrations:

Connect easily to banks and payment providers using secure, well-documented APIs. - Live Account Updates:

View real-time balances and transaction statuses as payments are processed. - Built-in Dual entry accounting:

Maintain a full audit-ready ledger to support compliance and financial controls. - Efficient Bulk Payments:

Process high-volume payments quickly and reliably. - Streamlined Reconciliation:

Access real-time bank reconciliation reports to reduce operational effort. - Comprehensive Reporting:

Generate customer statements and operational reports with ease.

Foreign

Exchange

Trusek gives your business powerful, flexible Foreign Exchange capabilities, with seamless integration to a wide range of third-party FX providers. This gives you direct access to the global currency markets you need,without lock-in.

Key FX features include:

- Broad Currency Coverage:

Support for 65+ currencies, enabling global reach and flexibility. - Multi-currency account structure

Hold multiple currency balances within a single account for simple management. - Full Control Over Conversions:

Decide when and how currencies are converted, with no forced FX. - Support for multiple trade types:

Execute Spot, Limit, and Future trades to suit different strategies. - Real-time FX Operations:

Perform instant conversions with live transaction recording for full visibility. - Instant Account Management:

Create and activate currency accounts in real time, ready for immediate use. - Simplified Settlement and Reconciliation:

Reduce operational effort with streamlined FX reconciliation. - Clear Actionable Reporting:

Generate detailed FX reports across trades, balances, and performance.

Integration to Forex &

Payment Providers

The API Connections Hub extends Trusek’s core platform, making it easy to integrate with trusted third-party providers across FX, payments, risk, compliance, and financial services.

This flexible integration layer allows you to plug in the services you need—without changing your core systems.

Supported external integrations include:

- Foreign exchange services for live pricing and conversions

- KYC and sanctions screening to support onboarding and compliance

- AML transaction monitoring for real-time risk detection

- Banking integrations and reconciliation for accurate settlement

- Savings, loans, and overdraft services

- Domestic and International payment networks

- Visa and MasterCard issuing and transaction processing

Card Issuing

The Trusek platform supports a wide range of card programmes, with flexible integration options to suit your business model. You can connect via direct card scheme membership or work with BIN sponsors, issuers, and processors.

Key capabilities include:

- API integration with third-party card issuers, processors, and BIN sponsors

- Single-currency and multi-currency card support

- Visa and MasterCard compatibility

- Business and Consumer card programmes

- Support for PrePaid, Credit and Debit Cards

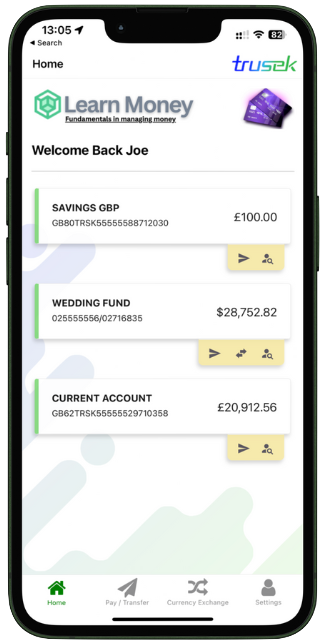

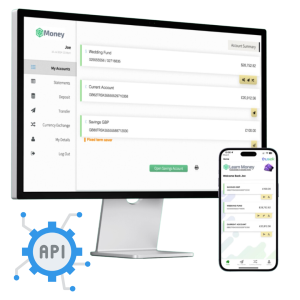

White Label Web,

APIs & Mobile Apps

- The Trusek platform is built for flexibility. You can tailor the solution to your exact needs using white-label web interfaces and powerful API integrations.

- To complete the customer journey, Trusek also offers optional white-label mobile apps for iOS and Android, giving your customers a seamless, branded experience across all channels.