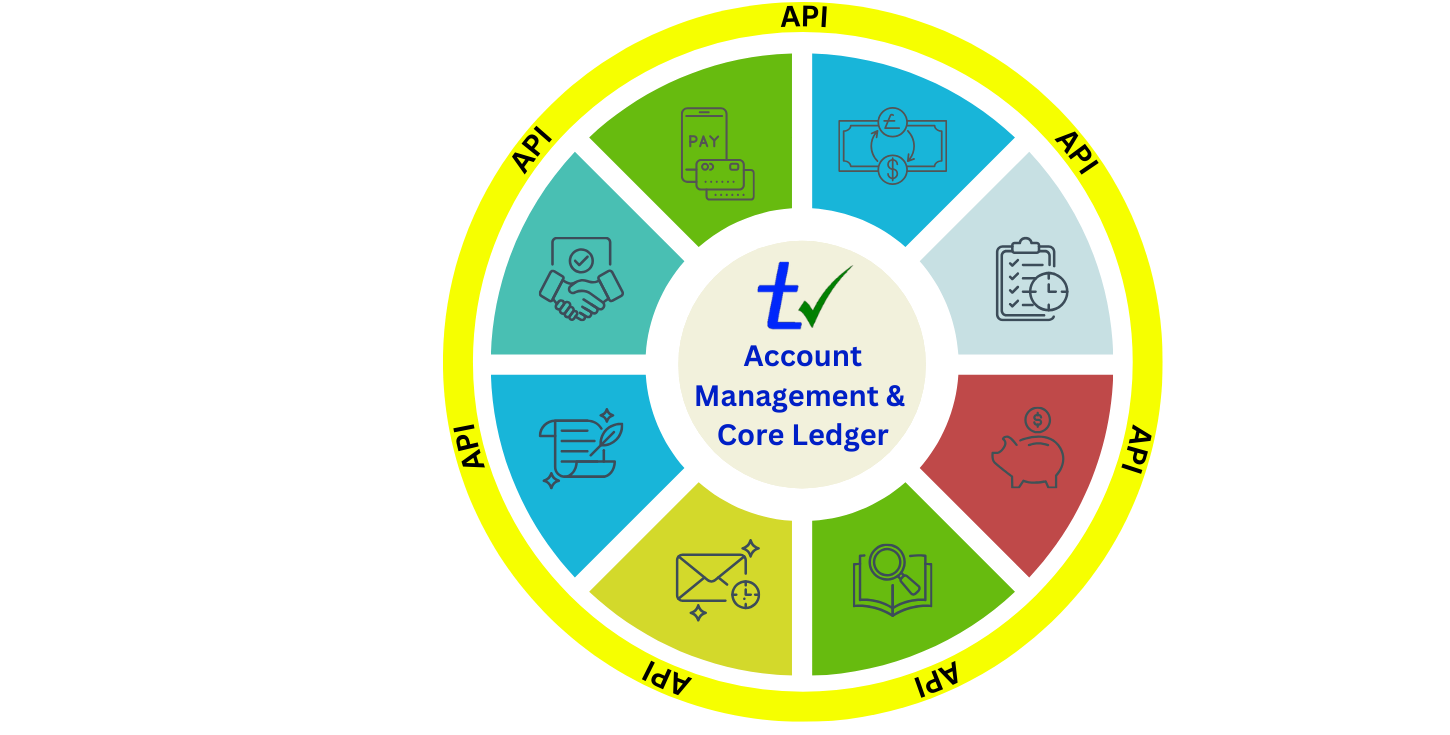

Solution Overview

Trusek provides a ready-to-go Banking-as-a-Service platform with everything you need to run core financial operations.

It includes the ledger, account management, risk controls, compliance tools, and reporting — all in one secure foundation.

With these building blocks in place, you can launch connected services faster and add new capabilities as you grow.

Advanced Core Ledger &

Account Management Platform

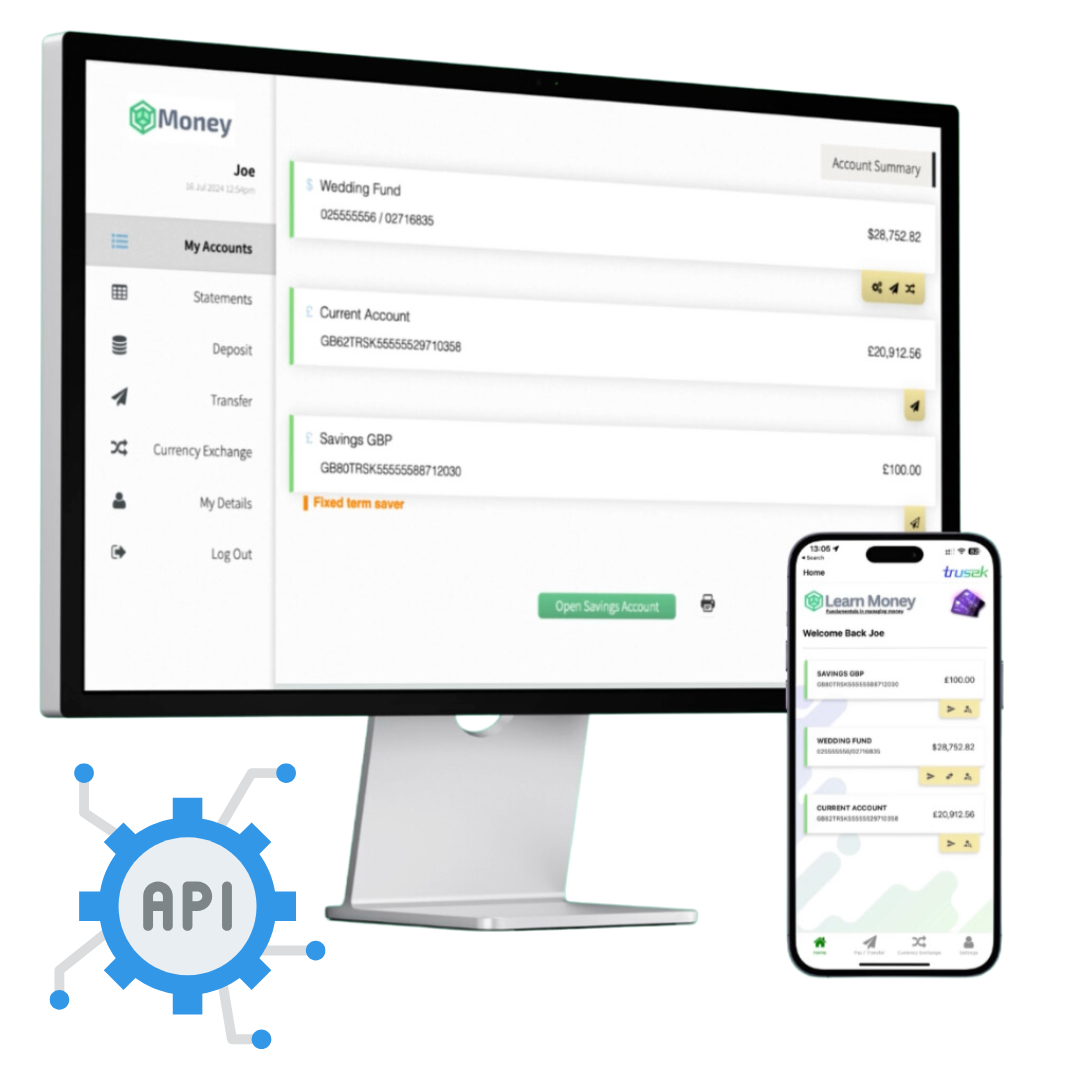

The Core Ledger & Account Management Platform brings together a set of simple, web-based interfaces that make it easy to run and manage financial services.

Built around multi-currency accounts, the platform provides a single, unified foundation for day-to-day operations, control, and growth.

This platform’s core functionalities include:

- Robust Transaction Processing:

Securely records all activities and transactions in encrypted, dedicated, fault-tolerant cloud-based databases. - Comprehensive Reporting:

Generates reports for management, regulatory compliance, and client needs. - Centralised Administration:

Offers a comprehensive back-end interface for managing all aspects of the platform. - Customer-Centric Interfaces:

Provides a user-friendly interface for customer registration, account management, and payment initiation. - Flexible Support Channels:

Includes a customer support call centre interface, adaptable for in-house or outsourced operations, as well as a branch/agent interface for face-to-face interactions. - Growth-Oriented Ecosystem:

Supports an affiliate program to incentivise referrals and drive client acquisition. - Enhanced User Experience:

Offers an optional white-label mobile app for iOS and Android for enhanced customer convenience.

This solution is built for flexibility. You can tailor it to your exact requirements using white-label web interfaces and powerful API integration options.

Designed to scale with your business, the platform supports expansion into new markets, higher transaction volumes, and evolving operational needs, without compromising performance or control.

“Single View” Dynamic

Multi-Currency account

Trusek enables true dynamic multi-currency accounts, allowing customers to pay in multiple currencies from a single balance—without the need to pre-fund each currency separately in advance.

| £ | Currency accounts set up in real time |

| $ | Single account to hold multiple currencies |

| ¥ | Simple user-friendly interface |

| € | Supports Spot, Limit & Future trades |

| ₦ | All trades recorded in real time into customer’s accounts |

| ₹ | Double entry accounting throughout to aid auditing |

| ₩ | Automatic Future payments |

| ฿ | Option to attach to a Visa/MasterCard |

| ₺ | Customer can access their accounts through Web, Call Centre, and Branch facilities (where available). |

Risk, Compliance &AML

Trusek helps you navigate complex regulatory requirements with built-in Risk, Compliance, and AML capabilities. The platform integrates seamlessly with trusted third-party services, enabling efficient due diligence and ongoing compliance across jurisdictions.

- Set & Regulate Onboarding Rules for KYB/KYC/AML compliance policies for all Clients

- API Integration to 3rd Party KYB/ KYC/ AML / Sanction List Service Providers

- Set and regulate ongoing checking rules

- In-built transaction monitoring capability for countries, currencies, beneficiaries, transaction amounts, transaction volumes etc

- API Integration with 3rd Party Transaction Monitoring Providers

- Comprehensive Reporting

Loans, Overdrafts and Savings

Trusek’s Ledger and Account Management modules fully support Loans, Overdrafts, and Savings products, providing all the core features needed to manage balances, transactions, and lifecycle events with confidence.

- Lending & Savings Capabilities: Robust functionalities for managing lending and savings products.

- Account Management: Comprehensive management of savings and loan accounts.

- API Integration to 3rd Party Savings and Loans Banking Partners

- Overdraft Management: Efficiently manage overdraft facilities for customers.

- Settlement & Reconciliation: Streamlined processes for settlements and reconciliations.

- Comprehensive Reporting: Generate insightful reports across all aspects of lending and savings operations.

- Interest Calculation: Accurately calculate interest daily, monthly, and annually.

- Product Information: Maintain detailed information about savings account products.

- Customer Application: Facilitate customer account application processes.

- Broker interface for applying and managing accounts, can be White Labelled

Additional Account Features

In addition to the multi-currency accounts the Trusek platform supports:

- Bulk upload and regular payments

- Loans, credit/debit cards, overdrafts and savings accounts

- Separate interfaces to support Call Centre, Agent and Admin functions

- e-invoice creation and management

- Affiliate programmes

API Connections Hub

The API Connections Hub expands the core service capability by supporting integration with third party Foreign Exchange, Payments, Risk, Compliance & Financial services providers.

- External integrations may include:

- KYC/sanctions checking

- AML transaction monitoring

- Banking and reconciliation

- National and International payments

- Currency exchange

- Visa/MasterCard transaction processing (issuing)

- Savings, Loans and Overdrafts

Cost Effective

Quick Setup

Scalable

White Label_Mobile App

White Label_Web UX

Learn Money

This app has been specifically designed to aid all age groups in the day-to-day task of managing money, this is a learning tool that has all the features you would expect to find with modern banking applications, including sending & receiving payments, managing recipients and currency exchange.